- Evaluation of Sustainability Practices

Review current sustainability initiatives to identify strengths and areas needing improvement, ensuring a comprehensive understanding of the present state.

- The selection of a suitable framework

Select the ESG report framework that is aligned with the goals of your business as well as industry standards like GRI, SASB, or TCFD to ensure that the framework is consistent and relevant.

- Defining Clear Goals

Create precise, quantifiable, realistic, relevant, and deadline-bound (SMART) targets for ESG Reporting and Assurance. This will aid the process and monitor the effectiveness of progress.

- Data Collection

Collect accurate and pertinent data from the social, environmental, and governance sectors. Ensure the data integrity is maintained by installing a robust system for managing data.

- Participation of Stakeholders

Include important stakeholders, customers, employees, investors, and members of the community to participate in the ESG Reporting and Assurance process to ensure comprehensive and meaningful disclosures.

- Conduct Verification and assurance

Select an independent third party to assure the key claims as well as KPIs of the sustainability report.

- Regular Publication and Accessibility

Publish ESG reports regularly and make them easily accessible to all stakeholders. This transparency builds trust and demonstrates ongoing commitment to sustainability.

What is

ESG Reporting and Assurance

ESG Reporting and Assurance includes a framework for organizations to display their environmental, social, and governance practices along with their impacts and influence. The reporting aims to levy transparency on how an organization manages various ESG risks as well as opportunities, to allow stakeholders like employees, customers, and investors to understand the company's commitment to ethical and sustainable practices.

ESG frameworks thus give a structured blueprint ensuring consistency and coherence in the sustainability landscape. ESG Reporting and Assurance functions as a conduit for companies to communicate their progress to potential investors and ensure that their initiatives can yield credible and actionable results.

What is ESG & sustainability

assurance and Verification

ESG and Sustainability assurance and verification is the process of independently validating and verifying a company's environmental, social, and economic impact data and claims through an independent third-party.

It improved the accuracy and credibility of sustainability data and disclosures to stakeholders, often by checking against recognized standards and criteria.

It can be dubbed as an audit for sustainability practices, providing greater trust in a company's sustainability reporting.

Why is ESG reporting and Assurance important for organizations?

Enhanced Transparency and Trust

ESG Reporting and Assurance provides detailed insights into a company's sustainability initiatives and operational impacts. Transparency builds trust with stakeholders and demonstrates accountability.

Attracting Investors with better ESG scores

Investors consider ESG factors in their decisions and

- CDP – Assurance of GHG is required to get leadership points and hence a “A” score

- GRESB – Global Real Estate Sustainability Benchmark – substantial weightage points assigned to assurance and verification

Consumer Loyalty

Consumers remain inclined to support brands that are committed to sustainability and ethical practices. ESG Reporting and Assurance strengthens brand loyalty by highlighting the organizational dedication towards positive social and environmental impact.

Regulatory Compliance

Various regulations across the globe mandated assurance of sustainability and ESG Data such as:

- CSRD – EU

- BRSR – India

- California SB 253 and US-SEC

- Turkey (TSRS), Singapore, Japan and the list is growing by the day.

Goal Setting and Tracking

ESG Reporting and Assurance sets and tracks sustainability goals. It helps companies in measuring their data-driven decisions and progress, for consequent improvement of ESG performance with time.

Risk Mitigation

It also assists in risk mitigation related to “ESG” issues. Proactive management of the risks helps companies safeguard their reputation.

ESG Reporting and Assurance Frameworks and Standards

TCFD- Task Force on Climate-Related Financial Disclosures

Following the establishment in 2015 by the Financial Stability Board, TCFD forms recommendations for disclosing financial risks related to the climate. It is integrated with the IFRS Sustainability Reporting Standards as per ISSB or International Sustainability Standards Board.

SASB- Sustainability Accounting Standards Board

SASB gives ESG Reporting and Assurance standards that are industry-specific through 77 metrics. It also offers a web tool called the Materiality Finder Tool for the identification of relevant issues based on ESG.

CDP- Carbon Disclosure Project

CDP is a not-for-profit organization studying the relationship between climate and environmental impacts, and the fiduciary responsibility for publicly-traded, large companies. Founded in 2000, CDP assists companies in disclosing carbon emissions data using questionnaires on water security, forests, and climate change.

UNGC- United Nations Global Compact

The UNGC is a voluntary initiative that promotes ten principles concerning labor, human rights, anti-corruption, and the environment, which supports different sustainable practices and developmental objectives in business.

IIRC- International Integrated Reporting Council

Founded in 2010, IIRC advocates integrated reporting and links ESG factors with financial performance. This helps in the provision of a holistic understanding and comprehensive outlook for value creation.

SBTi- Science-Based Targets Initiative

SBTi operating in the private sector motivates organizations to utilize science-based targets setting a 5-stage process. The targets need to be appropriate scientifically as per certain criteria for meeting the objectives of the Paris Agreement. Organizations of all industries and sizes can join as pathways specific to sectors remain developed.

PRI- UN Principles for Responsible Investment

This is supported by the UN to consider a network of investors worldwide, to whom they can provide support through consideration of investment implications related to ESG factors. The body operates independently in the interest of its investors, their financial markets and economies, as well as the environment and society as a whole.

What are the ESG Reporting and Assurance

Requirements?

Global Regulations and Standards

European Union (EU): The Non-Financial Reporting Directive of the EU requires large public-interest corporations to report non-financial data, including ESG information. The forthcoming Corporate Sustainability Reporting Directive will extend the requirements to include more companies.

United States: While ESG Reporting and Assurance is largely voluntary, the Securities and Exchange Commission (SEC) has proposed enhanced disclosure requirements for climate-related risks.

United Kingdom (UK): The UK requires large companies to disclose their energy use and carbon emissions under the Streamlined Energy and Carbon Reporting (SECR) framework.

Industry-Specific Requirements

Financial Sector: Financial institutions typically adhere to the guidelines that are issued by the Task Force on Climate-related Financial Disclosures (TCFD).

Energy Sector: Companies operating in the energy industry can adhere to Carbon Disclosure Project (CDP) standards and guidelines for specific industries.

Key Elements of ESG Reporting and Assurance Requirements

Environmental: Information regarding greenhouse gas emissions, electricity usage and waste management, the consumption of water, and impacts on biodiversity.

Social: Information about labor practices, human rights community participation, diversity and Inclusion, and the safety and security of our communities.

Governance: Details regarding the composition of the board as well as executive compensations, anti-corruption policies, as well as rights of shareholders.

Here is How You Can Initiate

Your ESG Reporting and Assurance Today

Decarbonisation

ESG Reporting and Assurance

Decarbonization is the reduction of carbon dioxide emissions that result from human activities with the ultimate aim of achieving a low-carbon economy. It is an essential part of a global effort to combat climate change and encourage sustainable development.

The Role of ESG Reporting and Assurance in Decarbonization

ESG (Environmental, Social, and Governance) reporting plays a pivotal role in decarbonisation by:

Monitoring emissions : ESG reports provide detailed reports of an organization's carbon footprint. They allow the tracking and measurement of emissions from greenhouse gases (GHG) carbon emissions.

Setting Targets: Businesses utilize ESG Reporting and Assurance to define and communicate their targets for decarbonization, for example, achieving net-zero emissions in a particular year.

Transparency: ESG reports ensures transparency, allowing stakeholders to understand the company's impact on the environment and its commitment to reducing carbon emissions.

Accountability: Using periodic ESG reports, businesses can be accountable for their carbon reduction efforts and progress.

Decarbonization Strategies Highlighted in ESG Reports

Energy Efficiency: Using energy-efficient techniques and methods to reduce the consumption of energy and carbon emissions.

Sustainable Supply Chains: Engaging suppliers who are committed to cutting their carbon footprint while adopting sustainable methods.

Renewable Energy: Moving to renewable energy sources such as wind, solar, and hydropower.

Innovation: Levying investments in leading-edge technologies that encourage the reduction of carbon emissions and sustainable development

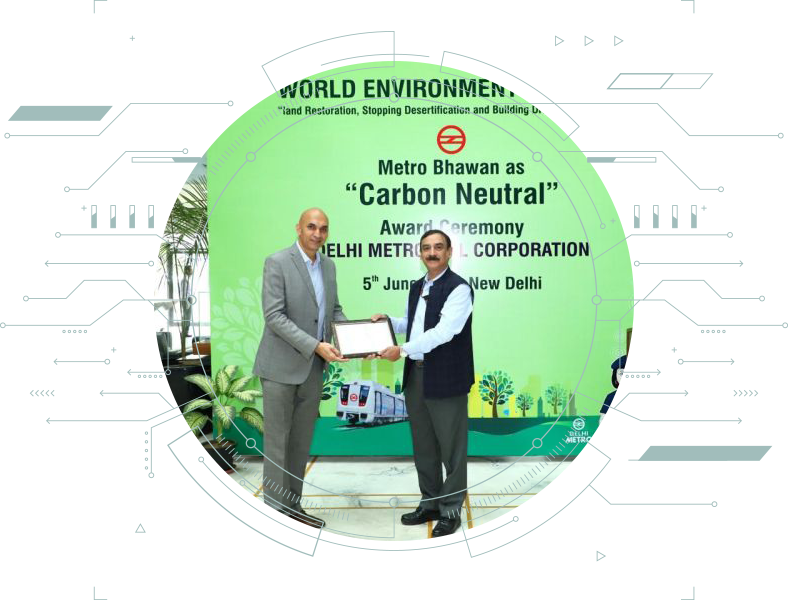

Why Choose Us for ESG Reporting and Assurance

- We are accredited and licensed across the global verification and assurance programs, and are the largest UN accredited carbon verifier.

- We have been awarded the best carbon verifier consecutively for 2 years.

- Highly experienced team in ESG and sustainability matters.

- Global experts based in Asia, Middle East, Europe, and the Americas with combined experience of 60 years and delivery of more than 1000 sustainability and ESG reports, verifications, and strategies.

- We work with all the globally and regional ESG and sustainability frameworks and standards like ISSB-IFRS, CSRD, BRSR, CDP, GRESB, GRI, GHG Protocol, among others.

- We use AA1000, ISAE3000 (revised), ISSA5000, ISO 14064-3, ISAE3410, ISO14068 – Carbon Neutrality Standard, and many other assurance standards.

- Bespoke and tailored verification and assurance program based on the key company needs and global & regional requirements.

- Customized scoping which can include assurance of just one KPI to multiple data sets, as well as comprehensive assurance across the whole of the ESG report including data, text, and claims.